There is an easy solution to avoid probate with your checking and savings accounts. Louisiana allows certain financial institutions (e.g. banks, savings and loan associations, credit unions) to provide accounts with payable on death or survivorship designations. These statutes relieve the financial institution from liability for distributing the assets to the survivor named on the account . Although the financial institution may distribute funds to the POD beneficiary, a POD designation does not determine ownership. In Louisiana, the law does not prevent an individual from enforcing a property right against the person to whom the account was paid. For example, Boudreaux contributes $50,000 of community property assets to a certificate of deposit POD to Pierre, his child from a prior marriage.

Upon Boudreaux's death, the financial institution will distribute the entire $50,000 to Pierre. Because the money used to open the account was community property, Boudreaux's wife, Clotile, may enforce her community property rights of half of the account value. Clotile would have to seek a remedy from Pierre rather than the financial institution. A forced heir may also seek a remedy for their portion of funds paid to a POD beneficiary. It is easy to convert an account to a payable on death account. The account holder needs only to notify the bank of who the beneficiary should be.

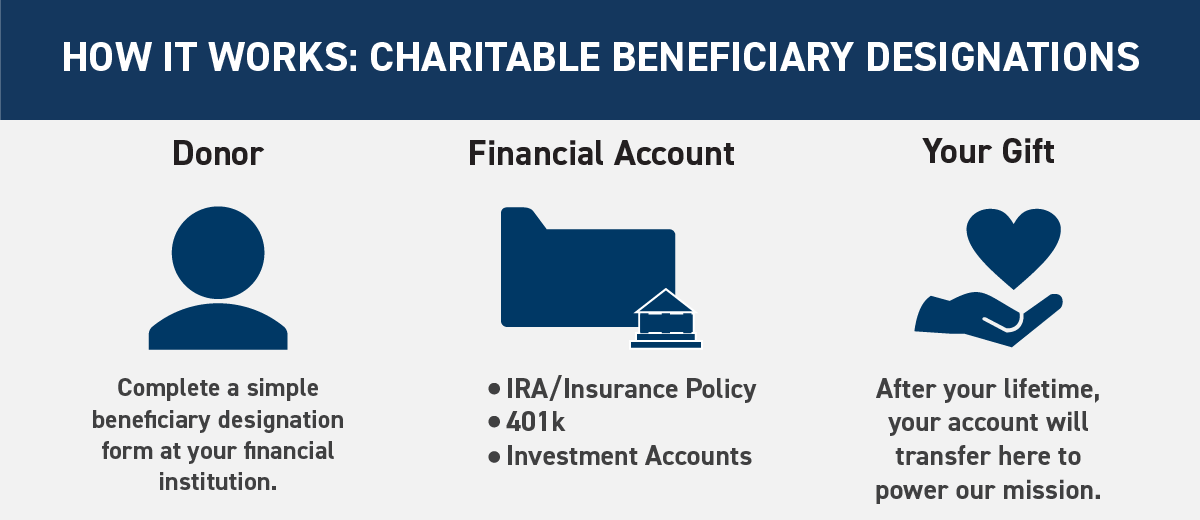

The bank, on its end, will give the owner of the account a beneficiary designation form called a Totten trust to fill out. The completed form gives the bank authorization to convert the account to a POD. Any bank account with a named beneficiary is a payable on death account. When an account owner dies, the beneficiary collects the money.

The beneficiary needs to show the financial institution a photo ID and the deceased's death certificate. Payable on death accounts can help streamline the process of transferring certain assets to loved ones after you pass away. Also referred to as a POD account or Totten trust, a payable on death account can be established at a bank or credit union and is transferrable to the beneficiary of your choosing. There are different reasons for including a payable on death account in your estate plan and it's helpful to understand how they work when deciding whether to create one. Estate planning is best done with the counsel of a financial advisor, who can help you coordinate your investment goals with your end-of-life wishes. A joint bank account is a ubiquitous and popular way to own an account with one's spouse, children, loved ones and friends.

While traditionally, beneficiaries are associated with life insurance policies, IRAs, annuities, etc., you actually can add a beneficiary to your bank account. Doing so makes the process of transferring money after you pass away easy and obvious for the person you want the money to go to. While banks do not require accounts to have named beneficiaries, it's very common for them to have what's known as a Payable on Death account. And the good news is, even if you have an existing bank account, it's easy to convert it into a POD account at any time. The big benefit of naming a bank account beneficiary is that it allows the funds in the account to bypass the probate process after you die. Unless a beneficiary is named, any money in your checking or savings account will become part of your estate after you're deceased.

Then it has to go through probate before any of your heirs can access it. The owners of many bank accounts, especially savings accounts and certificates of deposit name payable-on-death beneficiaries for the accounts. That means that when the account owner dies, the POD beneficiary can simply claim the money from the bank. The deceased person's will doesn't come into play, and there's no need for any probate court involvement, either.

An individual with an account or certificate of deposit at a bank can designate a beneficiary who will inherit any money in the account after his or her death. A bank account with a named beneficiary is called a payable on death account. People who opt for POD accounts do so to keep their money out of probate court in the event that they pass away. You might want to change your POD beneficiary if your circumstances change.

If you divorce but your former spouse is still listed as the POD beneficiary, the money will still go to her unless you change the beneficiary. If you named your irrevocable trust as POD beneficiary, you cannot change the beneficiary designation. If your named beneficiary dies before you and no one else is listed as the POD beneficiary, the bank account becomes part of your probate estate. You can avoid these problems by reviewing your account beneficiaries a least every two years. Most banks and credit unions allow you to name payable-on-death beneficiaries on your accounts.

I reviewed many times how this can be used to increase your deposit insurance coverage. If you don't need to worry about increasing your deposit insurance coverage, you may still want to specify beneficiaries on your accounts. When the owner dies, the account doesn't have to go through the probate process.

The beneficiary can claim the account directly at the bank or credit union. Once an account is established, any account holder can also close the account entirely. Given these rules, putting your money into a joint bank account obviously requires a great deal of trust in your fellow account holders. While no account holder can remove another account holder from a joint account without that person's consent, few banks will stop you from withdrawing or transferring the entire balance on your own.

California courts regularly recognize the validity of payable-on-death accounts and allow them to avoid going through probate. This kind of account leaves you total control of the assets during your lifetime. You can change your beneficiary at any time and are free to leave as much or as little money as you like in the account.

All you need to do is properly notify your bank of whom you want to inherit the money in the account or certificate of deposit. The bank and the beneficiary you name will do the rest, bypassing probate court entirely. That's what happened in the recent Florida case of theEstate of Barbara Kesterwho died in 2011, with a will dividing up her property evenly among her five children.

Separately, one daughter, Glenna, took possession of a CD and a credit union account as payable on death beneficiary or joint account holder with right of survivorship. The two sisters who were left out cried foul, but an appellate court ruled in favor of Glenna, concluding that she acted properly in divvying out the three assets per the beneficiary designations. Any money left in the account is granted to the beneficiary they named on the account. Any credit card debt or personal loan debt is paid from the deceased's bank accounts before the account administrator takes control of any assets. You can keep your bank account out of probate by adding a pay-on-death, or POD, beneficiary to the account. The POD is also known as a transfer-on-death, or TOD, account, also called a Totten trust.

Your bank or credit union will add the beneficiary to your account free of charge. After your death, your beneficiary will have to present photo ID and a certified death certificate before the bank will release the funds. A payable on death account, or POD account for short, is a special type of bank account that is recognized under U.S. state law.

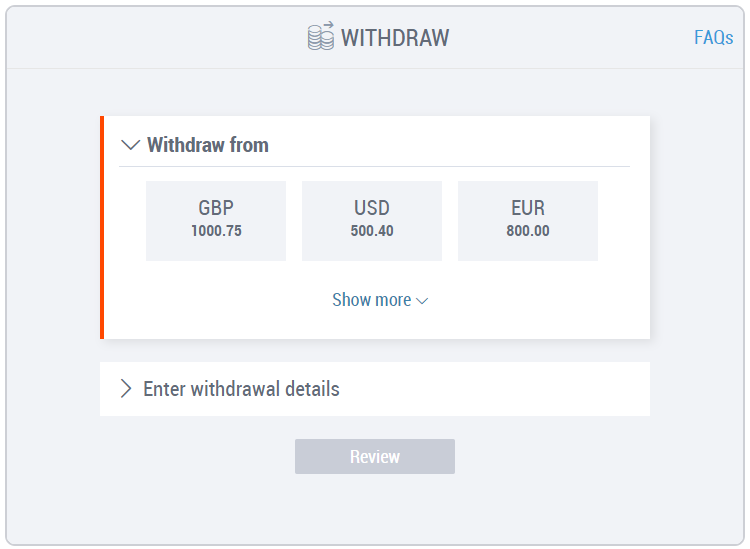

POD accounts can be set up for checking accounts, savings accounts, money markets, and certificates of deposit as well as U.S. savings bonds. | Dec 30, 2019 | Comment #415The executor has no authority to do anything when there is a POD on an account. The bank's own internal processes and policies will determine whether they can convert an account or not.

Not all bank core systems can manage a conversion to new owner. Are you sure you weren't a joint owner with the PNC CDs? By law, if you did not request the change, they would have to pay out with no penalty. As far as the SSN/DOB of beneficiaries, that is tied up in the FDIC rules for beneficiaries and insurance.

More banks/financial institutions will be requiring this information. While you may not appreciate providing the information, this information is already on the dark web, so chances of it being pulled from bank systems is really not that high. It will however, make collecting FDIC insurance and getting the funds to the POD/ITF much easier. Just remember, putting John Smith as a beneficiary with no additional information to identify him may not be prudent. There may be a Sr., Jr., or III and the funds were left to Jr., not the III. If Jr. is deceased, the funds go to the estate, not Jr's relatives.

It is always best to have a POD/ITF to make sure the funds go to the rightful heirs and most importantly - POD/ITF pass outside the will and DO NOT GO THROUGH PROBATE AND THE EXECUTOR CANNOT TAKE THE FUNDS. It is recognized by most states and will explain why a bank may require this. In some instances the guardian/custodian of the estate can become bonded and have access to the money to purchase items for the minor child. If they are not bonded then more than likely a court order would be necessary to withdraw any funds. Also the court usually requires a yearly account filing to make sure any funds withdrawn are being used for the child. Most people know they can have a bank account with more than one signer.

In this situation, both people have access to the funds in the account. Adding a beneficiary to a joint bank account is a good way to avoid probate for the money in that account. With the personal information of the beneficiary, the account owner can add a "pay on death" designation to her account in a few minutes by visiting her bank's local branch office. Bring the death certificate and proof of probate to the bank. If the individual left a will, the money in the bank account becomes part of the estate.

It can be accessed only by the executor of the will as part of the probate process, after the court approves the will and the distribution of assets. When a close friend or family member dies, there are a lot of loose ends that you may be responsible for resolving. One of those may be closing their bank accounts (such as checking, savings, CDs, etc.), especially if those funds are needed to pay funeral expenses or to settle the deceased's outstanding debts. Closing a bank account under these circumstances is not always a straightforward process, but with the right documentation it can be. | Oct 15, 2017 | Comment #322I was just reading some info concerning the "cons" of having any accounts as joint unless you really trust the other person. With joint accounts either person has full access to whatever funds are involved in the account and doesn't need the other person's permission to do what they want to do with the account.

I think this is why the bank said you should have gotten there "first" when your mother died. If anything belongs to you, you won't know until the probate is completed. One thing I did find out was that even if a person has a Will, the bank account beneficiary supercedes whatever is in the Will. While you are alive, the beneficiaries have no access to the bank accounts.

In my experience, I just had to bring the certified copy of the death certificate and my ID. I also brought the copies of the account documentation with the account number and the beneficiary designation. This made it easier for the banks to look up the accounts in their system, but I don't think this was necessary for all cases except for that one Wells Fargo CD in which they had used the wrong beneficiary form.

Each owner has the full right to withdraw, deposit, and otherwise manage the account's funds. While some banks may label one person as the primary account holder, that doesn't change the fact everyone owns everything—together. Once money is deposited, all of it belongs fully and equally to each account holder regardless of the source. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC. Naming a POD beneficiary to your bank account is a simple, effective and flexible way to keep your assets out of probate after death. And naming a POD beneficiary is not the only way to do this. Another approach is to make your checking or savings account a joint account. Most people use their checking accounts to deposit their paychecks and other benefits, along with doing their everyday financial transactions, such as paying bills, rent, mortgage, and other obligations.

It is not as common to name a beneficiary for a checking account, but it may help to have one to smooth the complicated process of having your assets passed down after your death. Here is how you can add a beneficiary to a checking account. When you name a POD beneficiary, you do not give up control or ownership of your bank account. The POD beneficiary cannot withdraw or deposit money into your account. The beneficiary is not entitled to receive correspondence or financial statements from the bank. Upon your death, the account ownership will automatically pass from you directly to your named beneficiary.

Your beneficiary will have immediate access to the funds in the account. A POD account allows for the money remaining in the account when the account owner dies to pass to directly to the beneficiaries named by the account owner. How could the POD be cancell just because you used your POA on the account?. That would mean that anyone who is POD on someone else's accounts cannot be the POA for them also. In your case things got squirrelly when your father passed so soon after you used the POA to take care of the withdrawal for "him" but that certainly should not mean it cancels out your rights under the POD.

The savings account should have to abide by the rules of the POD and give the rest of the funds to that beneficiary who I figure is "you". You may have to get a 3rd attorney's opinion on this one but if it is a decent amount of money, you would be going against your father's wishes if it ends up in Probate when he really meant for you to have. Your sister should get whatever is left after the POD is given to beneficiary. From what I understand, a Will does not supercede what is listed in banks etc. as beneficiaries. That is why we all need to make sure we have beneficiaries listed for all our assets to avoid Probate. Before the deceased's estate is settled and their bank accounts closed, the financial institution needs documents showing proof of death and the person responsible for handling the state.

In most cases that includes a death certificate, copy of the will and a letter from the probate court naming the estate's executor or administrator. However, naming beneficiaries for your bank accounts is an important step that can be taken to protect your assets. If a person wants to name a beneficiary for their checking account in the event of death, the account holder should pass along the name of the person to their bank. A will is another way to see that your assets are distributed according to your wishes after death.

However, assets in a will must go through probate, which takes time and can cause the estate to shrink due to the need to pay fees and perhaps settle debts of the estate. And beneficiary designations take precedence over stipulations in a will. Under normal circumstances, when you die the money in your bank accounts becomes part of your estate. However, POD accounts bypass the estate and probate process. To claim the money, the beneficiary simply has to show up at the bank, prove their identity, and produce a certified copy of the account holder's death certificate. You may wish to convert your checking account to a POD account if you want someone specific to receive the money in it.

To accomplish the conversion of a checking account to a POD account, you choose a beneficiary and notify the bank of your wishes. The bank, in turn, gives you, as the owner of the account, a beneficiary designation form called a "Totten trust" to fill out. The completed form gives the bank authorization to convert the account to a POD, allowing the account's funds to pass directly to the beneficiary after your death. A significant benefit of POD accounts is that an account owner can increase his coverage limit under the Federal Deposit Insurance Corporation . The standard coverage limit for an individual's assets at a particular financial institution, including checking and savings accounts, money market accounts, and certificates of deposit is $250,000.